The risk assessment process is a vital part of underwriting. Insurance companies measure the risk before underwriting. Insurance companies spend tons of dollars to get risk assessment right, though there is not a one-stop place that can help in this area.

I was responsible for all aspects of the project, from requirements gathering, experience, visual design, and usability testing. I collaborated with stakeholders across all LOBs (Line of Business) to lead design workshops, conduct both individual interviews, collect feedback, and facilitate UT sessions.

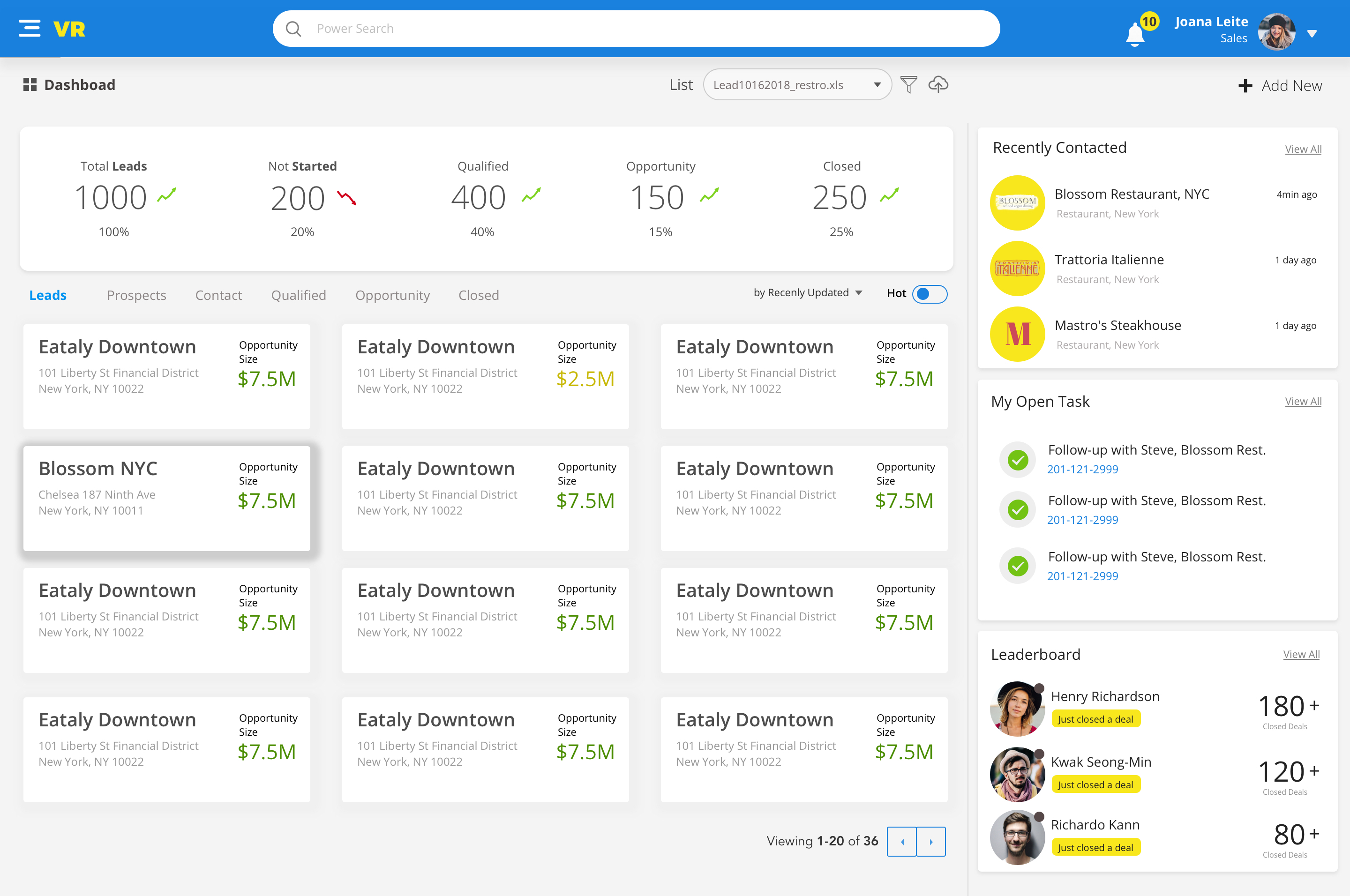

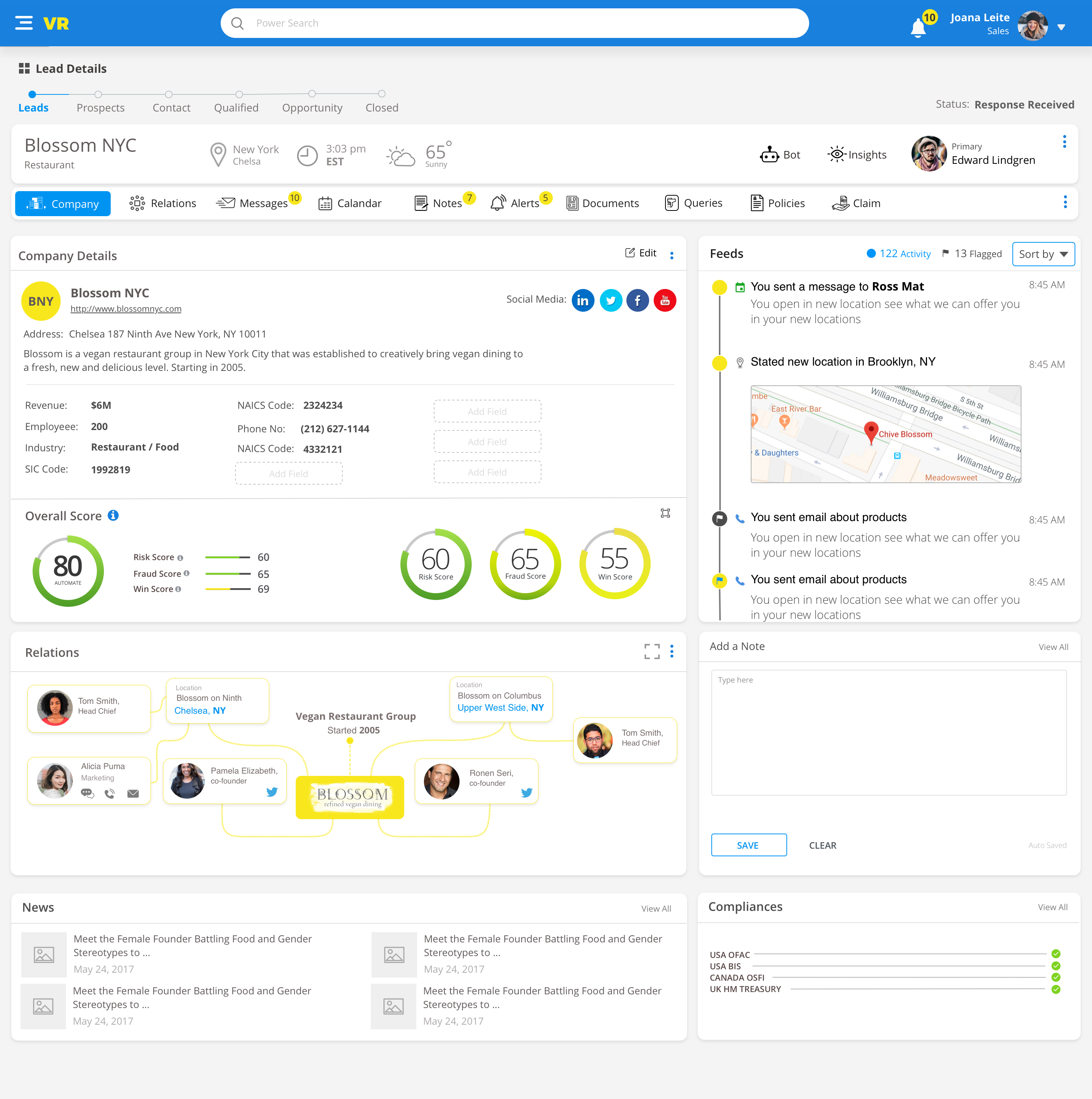

We designed a concept application for measuring risk assessment. A Visual Risk 2.0 minimizes time spent on simple applications and provides valuable risk data so that an underwriter can spend most of their time working on complex applications, with a wealth of data presented without additional research required.

Improved Productivity

Increased Submission-to-Bind Ratio

Reduced Costs

Enhanced Risk Management

Target users for this application was underwriters age 35-45 and submission technicians age age 25-30.

We have planned multiple internal design thinking sessions, with numerous success matter experts. It helps us to identify problem areas and solve specific cases. We define goals for the application and establish the purpose.

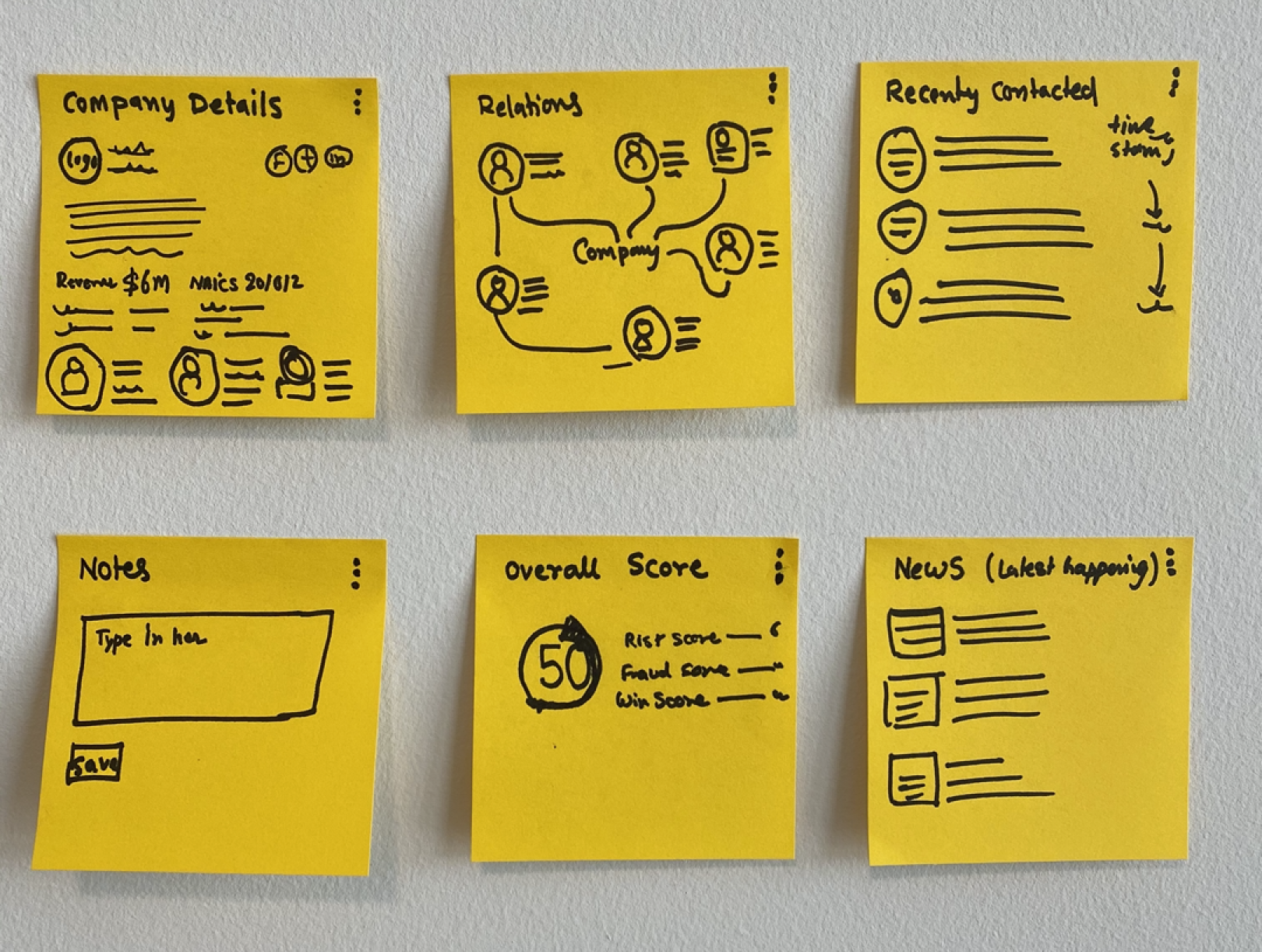

We come up with 3 concepts to solve the problem for the initial phase. We did multiple prototypes and validated them with subject matter experts and internal stakeholders.

To evaluate our concept, we validate our prototypes with internal stakeholders and subject matter experts. We show the demo to our existing customers and received feedback.

We have successfully onboard a few insurance customers with customization.

Based on customer feedback, we evolve ideas into the custom tailor-made experience for our insurance.

What can I do better?

- Spend more time on qualitative research.

- Include a broader audience into the project feedback.

- More flexibly and budget